The corona crisis affected numerous professionals in a negative way. Others can however make profit from the situation by playing it smart, such as international car traders.

The corona crisis has had a negative impact on the car market, which does not mean that traders cannot reap the benefits. For example, the crisis affecting various European countries has created opportunities for cross border activities.

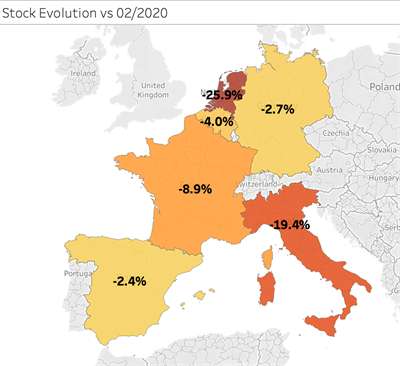

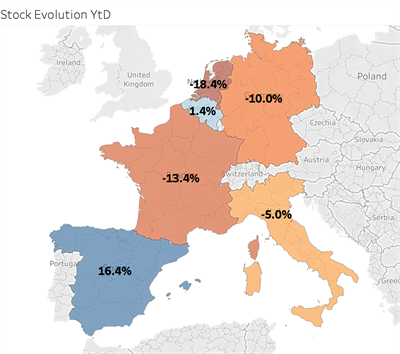

The crisis also caused a clear international decline in the number of available vehicles compared to 2019. Between April and September, the figures went up again, although the supply remains generally lower than last year despite this rebound.

The increase just mentioned varies from country to country, with a difference in prices as well, which creates opportunities for cross-border sales. We analysed the figures for Belgium, France, the Netherlands, Germany, Spain and Italy and found a clear increase in available vehicles in all of these countries during the summer months (after the first corona wave), with a peak in June and July depending on the country, a (slight) decrease in August and a (serious) rebound each time in September, while the number of cars for which a decrease in prices was recorded showed the same trend.

Anyone who takes a smart approach can benefit from the difference in political visions of the various governments. Just think of tax benefits for electric cars, which are for example high in France and non-existent in Belgium. In addition, the available stock of some models in high demand is too low in certain countries, which in turn creates opportunities for international purchases. Below we give a brief overview of the situation in the countries just listed.

Belgium

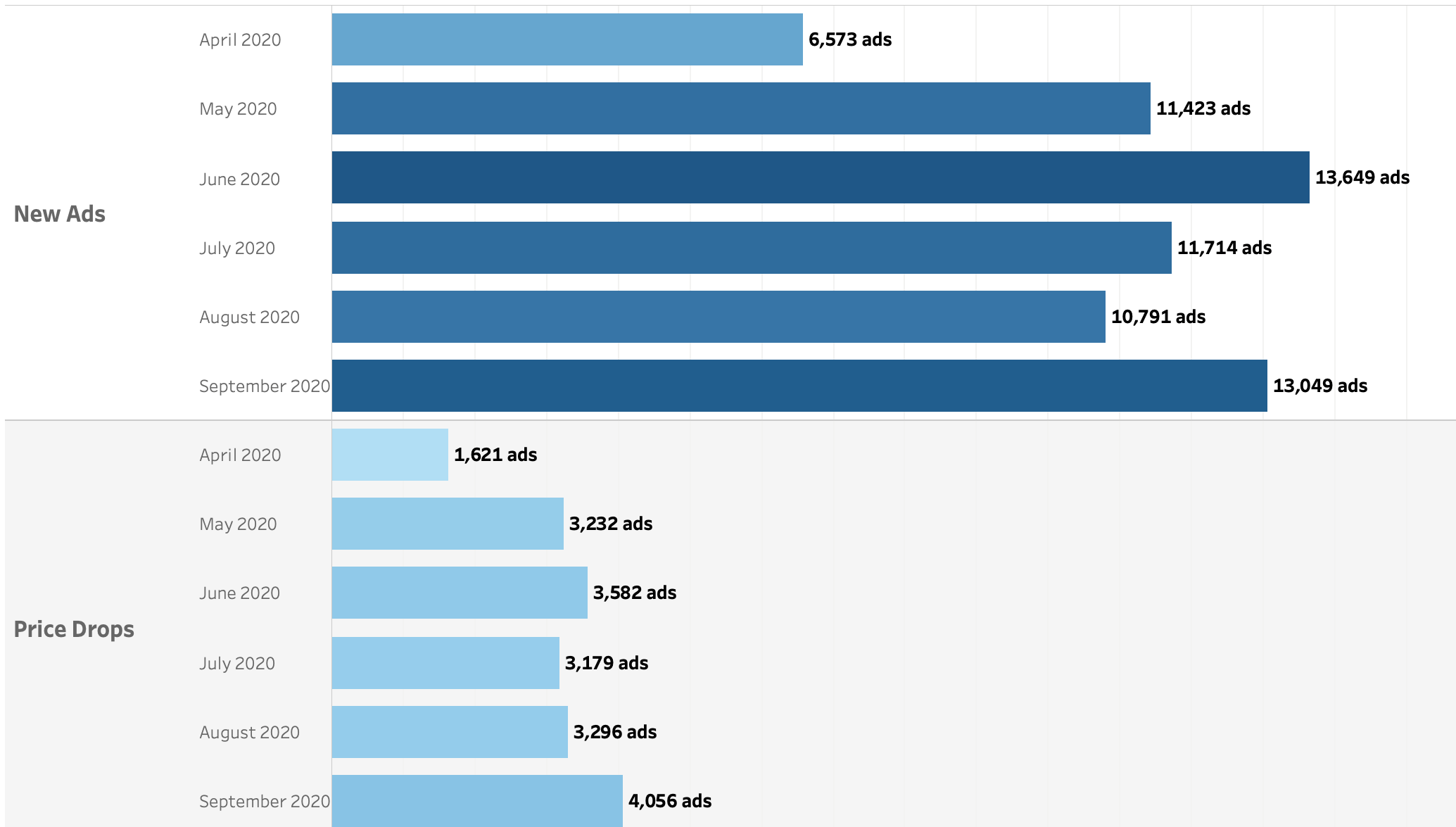

In Belgium, in April of this year, 6,573 ads of cars that were not previously for sale (new and second-hand) were placed online. This number almost doubled in May, with a peak of 13,649 new ads in June, before dropping to 10,791 in August and rising again in September, to 13,049. The price decreases followed more or less, with the difference that more price drops were noted in September than in the peak month of June (4,056 against 3,582).

In mid-September; a 7% drop in the number of available cars in a single year was calculated, although the volume remained stable when comparing the months of August (2019-2020), with even a slight increase of 0.6% in August 2020. With regard to the supply of light commercial vehicles (LCV) in September, a decrease of 8.5% was recorded, although the supply is still 4.8% higher than in August, which makes the situation interesting for buyers.

The Belgian second-hand car market is 64% in the hands of professional sellers. The average purchase price of a car from such a professional was 24,432 euros in September this year, 0.7% higher than in August. For cars from private sellers, the increase was higher (1.45%, to 13,009 euros). Also interesting to know, 37% of the ads in August were less than 30 days old, compared to 42% in September. Nevertheless, used cars are generally on sale online for a longer period of time, with an average of 47 days when looking at ads from professionals (compared to 37 days in August) and of 37 days when looking at ads from private sellers (compared to 30 days).

In Belgium, 15.9% of the available cars are categorized as cars of the so called C segment (example: VW Golf), followed by city cars (14.9%), station wagons (13%), sedan cars (12.5%) and compact SUVs (10.8%). Cars with a manual gearbox make up 66% of the offer, diesel 53.1% and gasoline 44%.

France

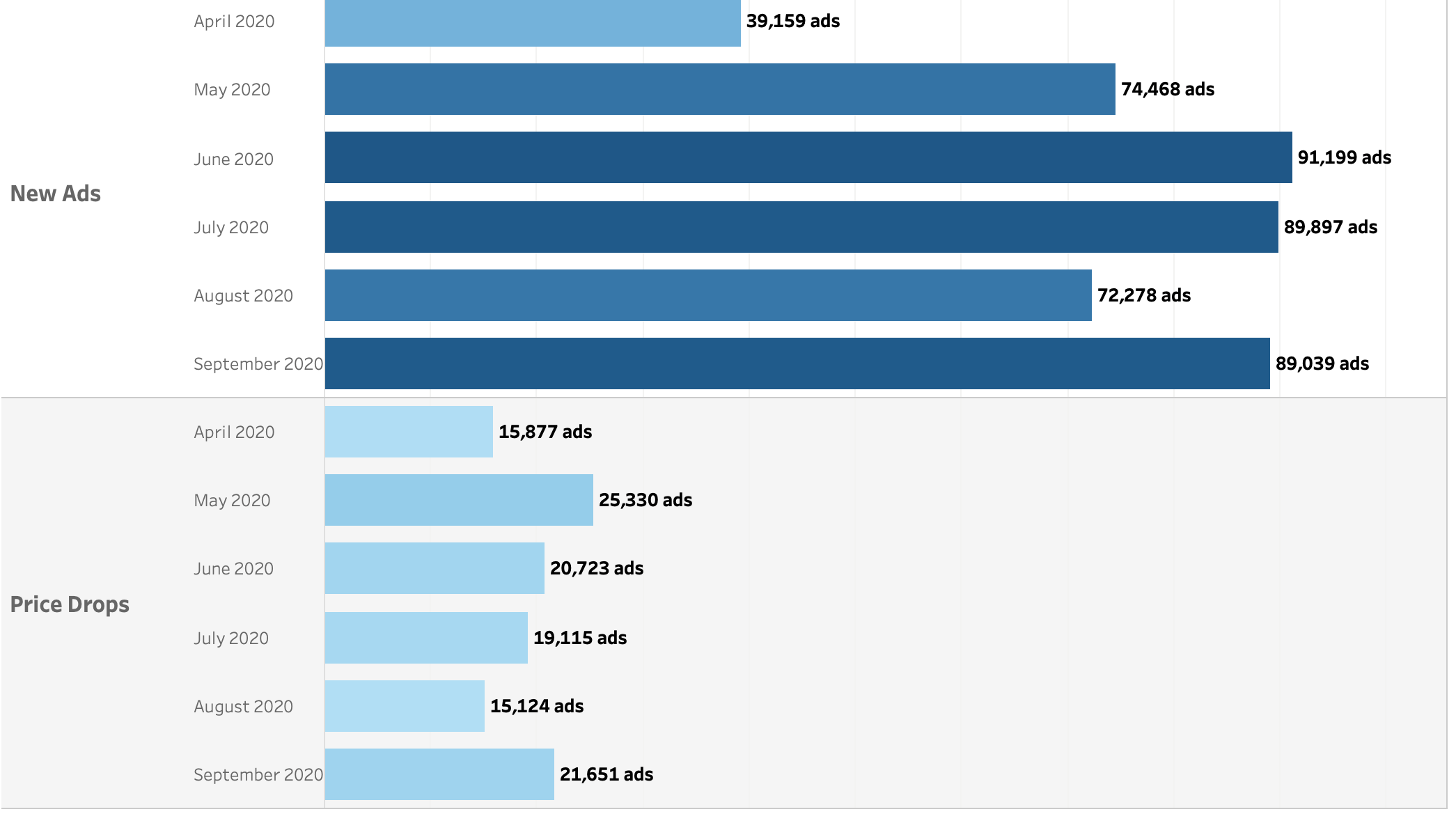

In France, 39,159 additional ads appeared in April, much less than in May (74,468) and in the peak month of June (91,199). July accounted for a slight decline, to 89,897, while the number of new advertisements fell back to 72,278 in August. In September the number of new advertisements rose sharply again to 89,039.

In terms of the number of price decreases, the peak month was May (25,330), with a low in August (15,124), followed by a hefty increase in September (21,651).

In mid-September, supply in France was 5.45% lower than last year and 3.1% lower than the month before. 60% of these vehicles came from professionals and 50,883 were LCVs, up 7.15% from the same date last year, and still 0.9% more than the previous month. 47% of these ads were less than 30 days old, up from 43% in August. However, the average time the ads staying online is getting longer: 58 days for professionals and 24 days for individuals, compared to 41 and 19 days respectively, calculated on August 15, 2019.

The average asking price for cars from private sellers increased by 4.2% in one month to 10,527 euros, an increase that is less pronounced among professional sellers (+0.92% to 22,049 euros). However, if we look at used cars between 5 and 8 years old, there was a significant price increase among professionals of 8.7%, to an average of 15,786 euros.

In France, small city cars dominate the supply (18.5%), followed by compact models (17.4%), compact SUVs (11.7%) and MPVs (10.6%). Diesel vehicles make up 61% of the offer, gasoline cars 35.7%.

Germany

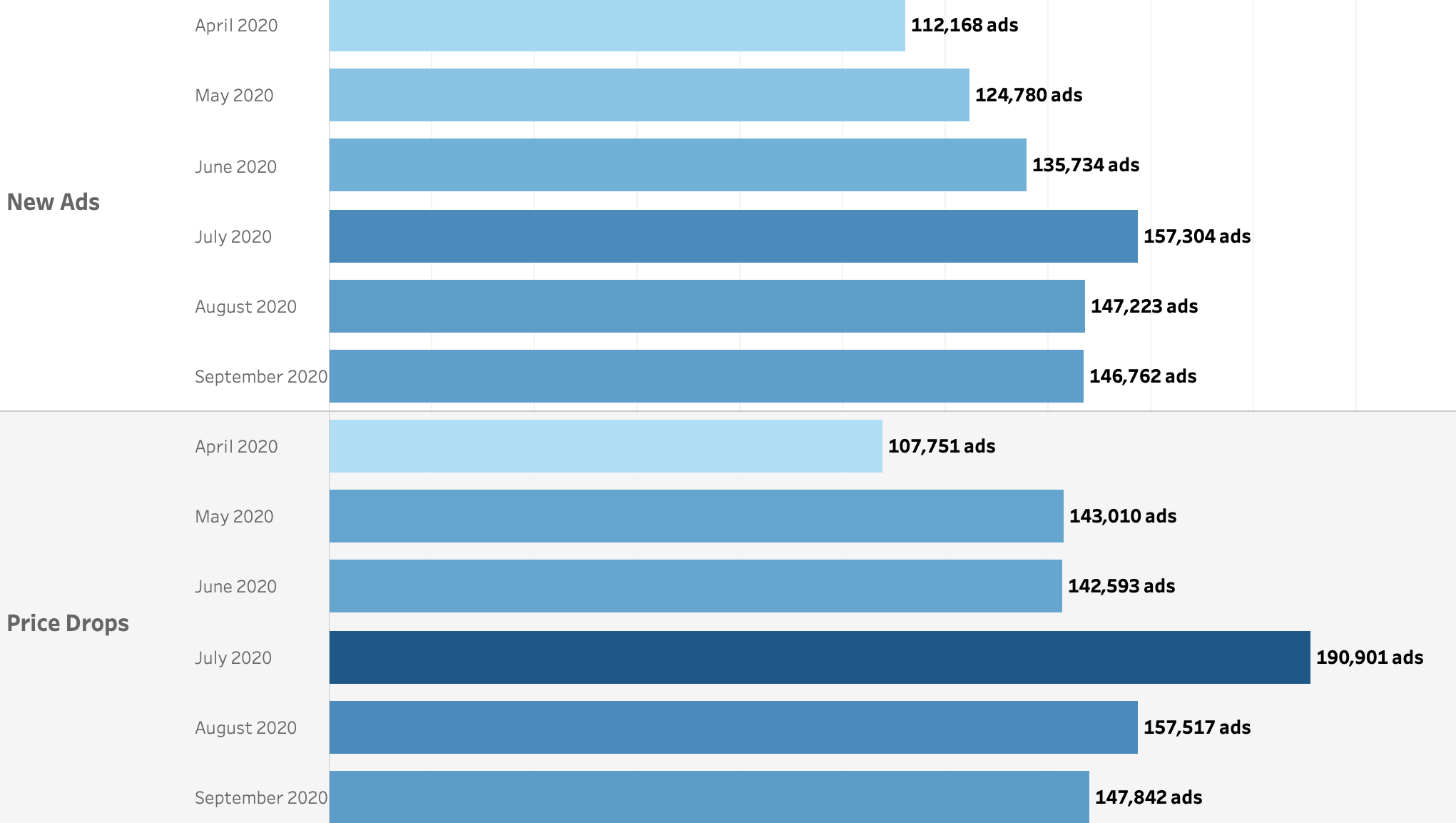

In Germany, the number of new advertisements rose from 112,168 in April to 157,304 in July, before dropping to 146,762 in September. The curve of price decreases in ads is slightly more extreme, with 107,751 in April, a peak of 190,901 in July and 147,842 in September.

Know that stocks are gradually decreasing in Germany. Although supply increased significantly between September 2019 and 2020 (+19.1%), it has decreased by 1.2% between August and September 2020. LCVs are an exception, with an increase of only 2.8% since last year, but again a decrease of 2.13% in August this year.

In terms of the average number of days that German cars are for sale, we speak of an increase of 5 days for professionals and 6 days for private sellers compared to the same period last year. 42% of the ads were online for less than a month in mid-September, compared to 41% a month earlier, and at the same time there was an average price drop of 1.66% in August.

Compact models make up 15.4% of the offer in Germany, station wagons 14.9%, city cars 13.5% and compact SUVs 12%. Looking at the fuels, we speak of 58.9% gasoline cars and 38% diesel models. The supply of models with a manual gearbox climbed a little, up to 57.3%.

Italy

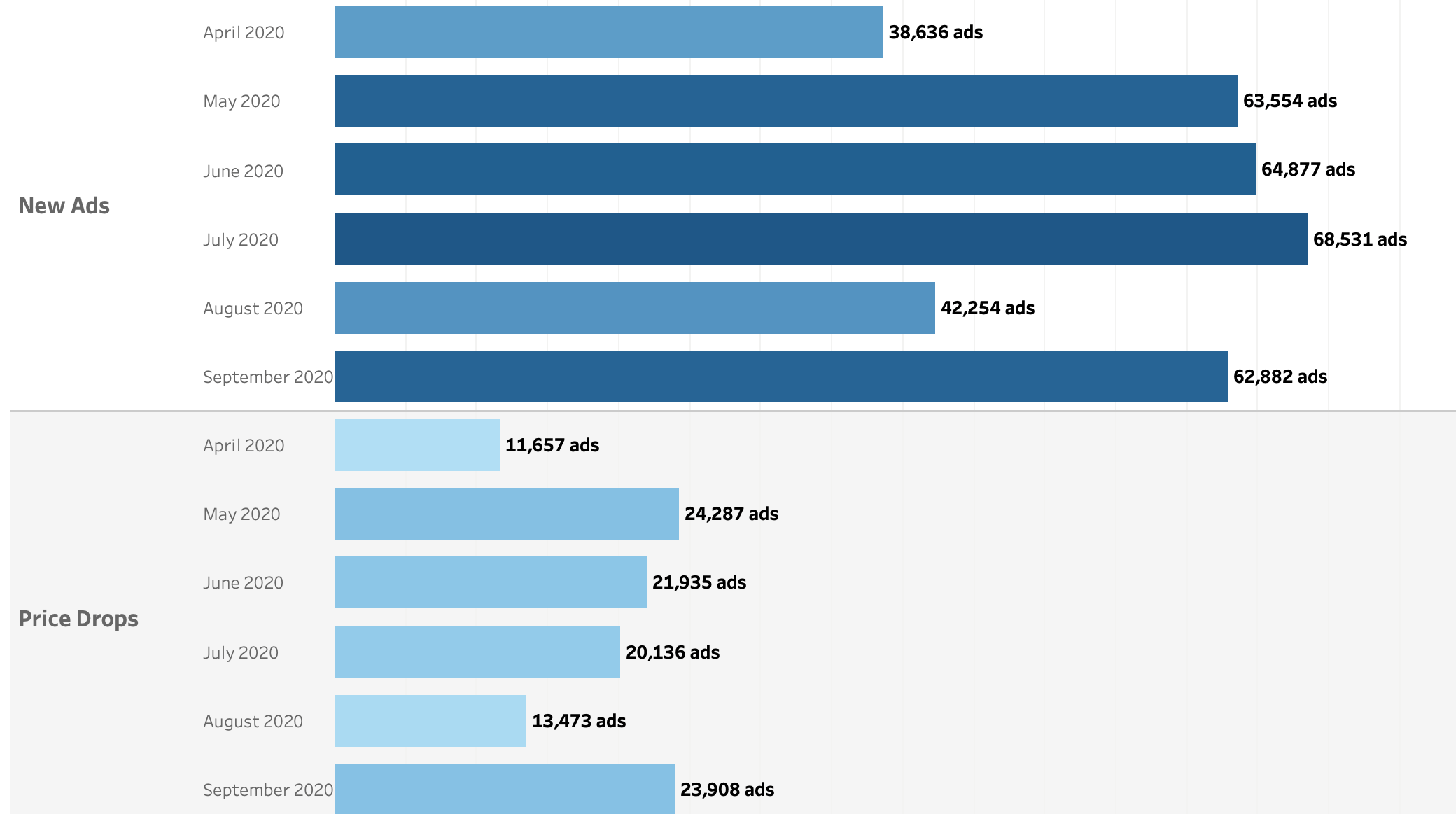

In Italy, the number of new ads went up from 38,636 in April to 63,554 in May, to peak at 68,531 in July. Most price decreases were recorded in May (24,287, coming from 11,657 in April) and September (23,908, coming from 13,473 in August).

From September 2019 to September 2020, the number of advertisements in Italy decreased by 5.4%, with an offer in September 2020 also 1.15% lower than that of mid-August 2020. The drop is more significant when looking at the supply of LCVs: -12.6% in one year and -2.6% in one month. Professional ads accounted for 67% in September, down 4% compared to August.

Over a month, the average price of second-hand cars offered by professionals rose by 3.8%, to 19,107 euros. The reverse was true for private cars, for which a fall of 1.4% was recorded, to 9,915 euros. It is true that second-hand cars from the latter group were online for a longer period of time, up to 54 days in September, while cars from professionals took an average of 60 days to find a buyer. 26% of the ads were online for less than a month.

The majority were city cars (18.6%), followed by compact models (17.4%), compact SUVs (11.7%), and compact MPVs (10.6%). We also speak of 62.9% diesel models, 28.8% gasoline cars and 4.5% LPG-powered cars. 65% of the available cars are equipped with a manual gearbox.

Spain

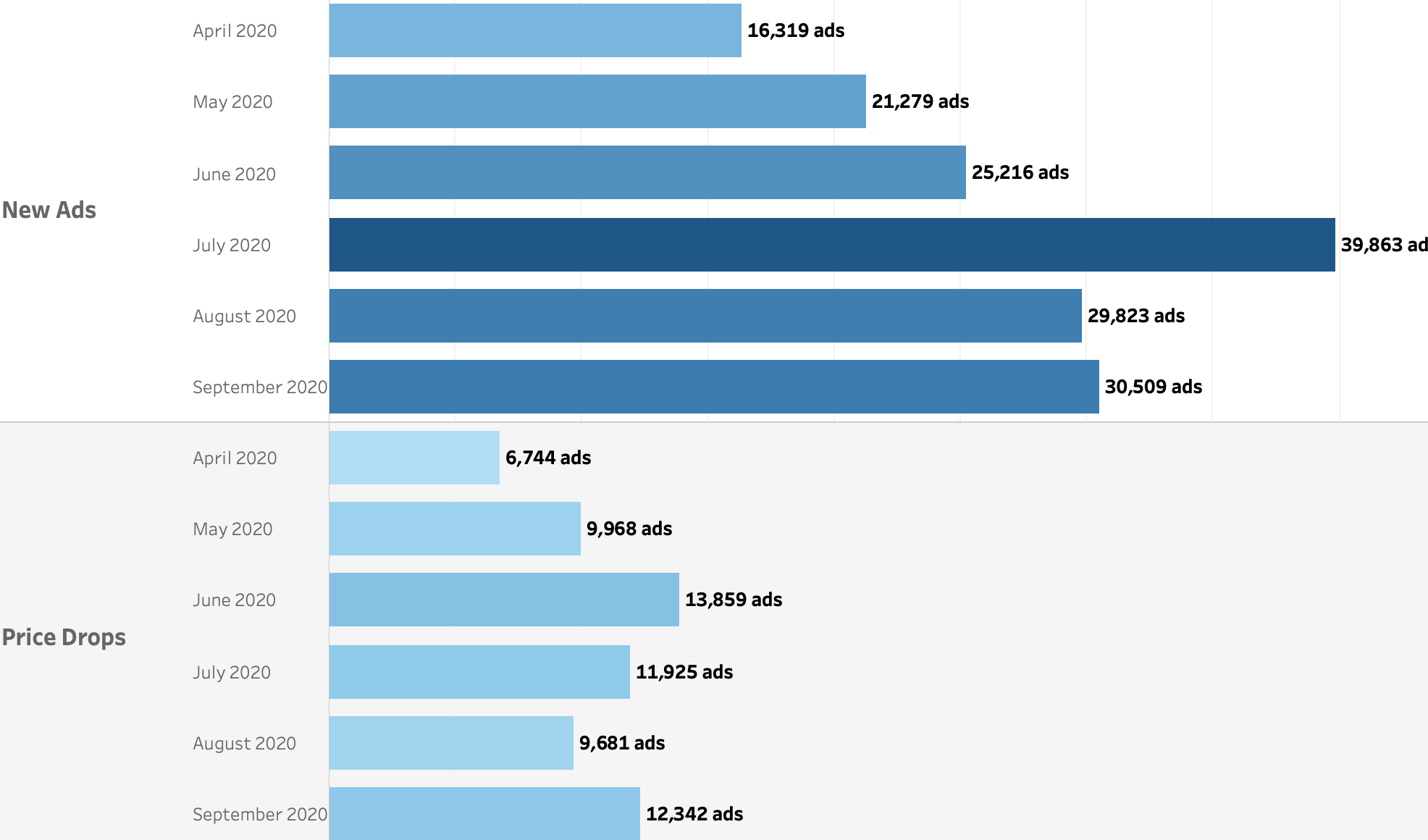

The number of new ads in Spain gradually increased from 16,319 in April to 25,216 in June, before rising sharply to 39,853 in July. August accounted for a drop to 29,823, only to rise slightly again to 30,509 in September. The curve of price decreases is the same from April to June, but not at all for the peak month of July when 11,925 cars fell in price, compared with 13,859 in June. September saw 12,342 price declines compared to 9,681 in August.

Compared to last year, there are more cars for sale in Spain. Comparing September 2019 to September 2020, an increase in supply of 11.7% is noticeable. The opposite is true from August to September this year, with a decrease of 0.75%. The same is true for LCVs: between 2019 and 2020, their supply increased by as much as 41%, while between August and September this year, it already decreased by 0.95%.

The number of cars that were online for less than 30 days, which accounted for 21% of the total in August, rose to 26% in mid-September. Good news for some sellers, but certainly not for everyone: the average age of advertisements from professionals has risen from 58 to 92 days in one month, advertisements from private sellers from 64 to 73 days. In both cases, we are well above the average of the countries mentioned above and last September's prices were the lowest: among professionals 18,518 euros, which was admittedly a very slight increase compared to August, and among private sellers barely 9,963 euros.

Compact models are most strongly represented on the Spanish market (19.7%), followed by sedan cars (18.4%), city cars (12.8%) and SUVs (12.1%). Diesel cars account for 64.6%, gasoline cars 32.6%. In terms of transmissions, there are many more models with manual gearboxes for sale in percentage terms than elsewhere. We are talking about 70.1%.

The Netherlands

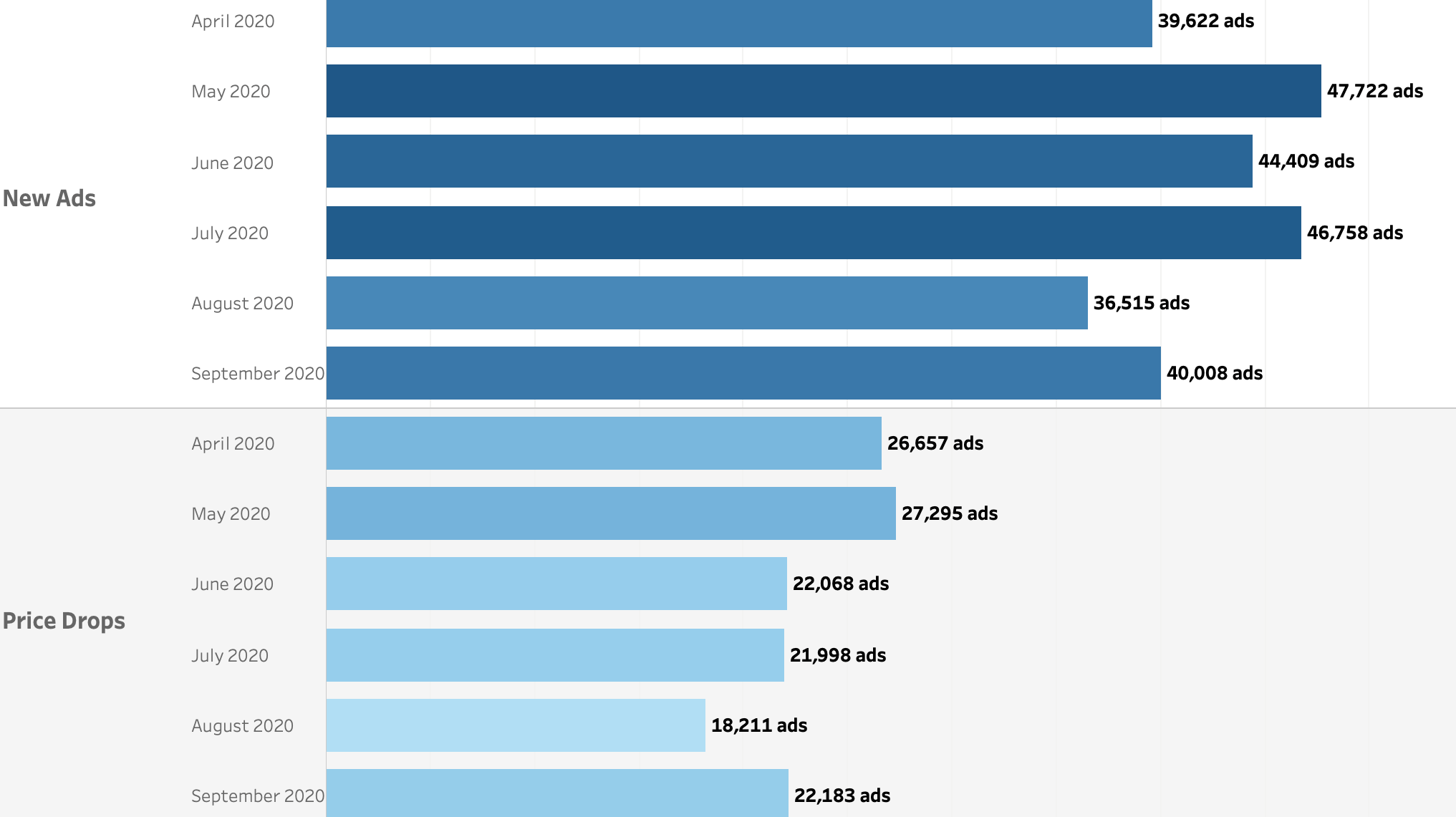

In the Netherlands, the situation is clearly different, with May as the peak month in terms of the number of new ads (47,722, compared to 39,622 in April, 44,409 in June and 46,758 in July). The lowest number was recorded in August (36,515), while the level of April was almost reached in September, with 40,008 ads. Price decreases were most frequent in April and May (up to 27,295), while in August only 18,211 were recorded, and their number was almost the same in June, July and September (up to 22,183).

The situation of the Dutch market is special compared to the other countries. Since October 2019, the number of vehicles for sale there has fallen sharply, by as much as 17.3%, which means a drop in supply. This is still most applicable to the used car market. Between mid-August and mid-September, there was an increase, albeit only 2.2%.

The market share of new stock cars in the Netherlands amounts to more than 12% of all available cars, while in most countries this share is below 10%. The only exception is Germany, where we speak of a total stock of more than 1.4 million cars.

Also important to know is that the fiscal situation for new cars in the Netherlands is very complicated, which means very high prices for new cars and an imbalance between supply and demand. Of all advertisements, 63.97% are placed for sale by professionals.

In The Netherlands, city cars are the most represented on the total market (24.2%), followed by compact models (16.9%), sedan cars and station wagons (both 11.1%), compact SUVs (7.4%) and LCVs (7%). Petrol cars make up the vast majority of the offer (74.3%), compared to 20.4% diesel cars.