2020 has been a challenging year for the market, even if the second-hand activities have maintained a reasonable level of performance. Nevertheless, as for many aspects of the society, Covid has been an acceleration factor for many aspects. In today’s situation, the volatility of the European markets has never been so high, creating a wide range of opportunities for buyers and sellers, if they are both using the right tools.

For this analysis, we’ve studied the vehicles auctioned by OPENLANE during last November, December and January. For each of those cars, we’ve calculated their market value (Consumer price) and time to sell (average days of stock) using Gocar Data, the largest market observation platform in Europe, as reference.

As we focus on the cars auctioned by OPENLANE, this is not a complete market analysis, but it’s a comprehensive cover of the vehicles found on the platform. These are typical cross borders sales, making this a relevant approach to our activity.

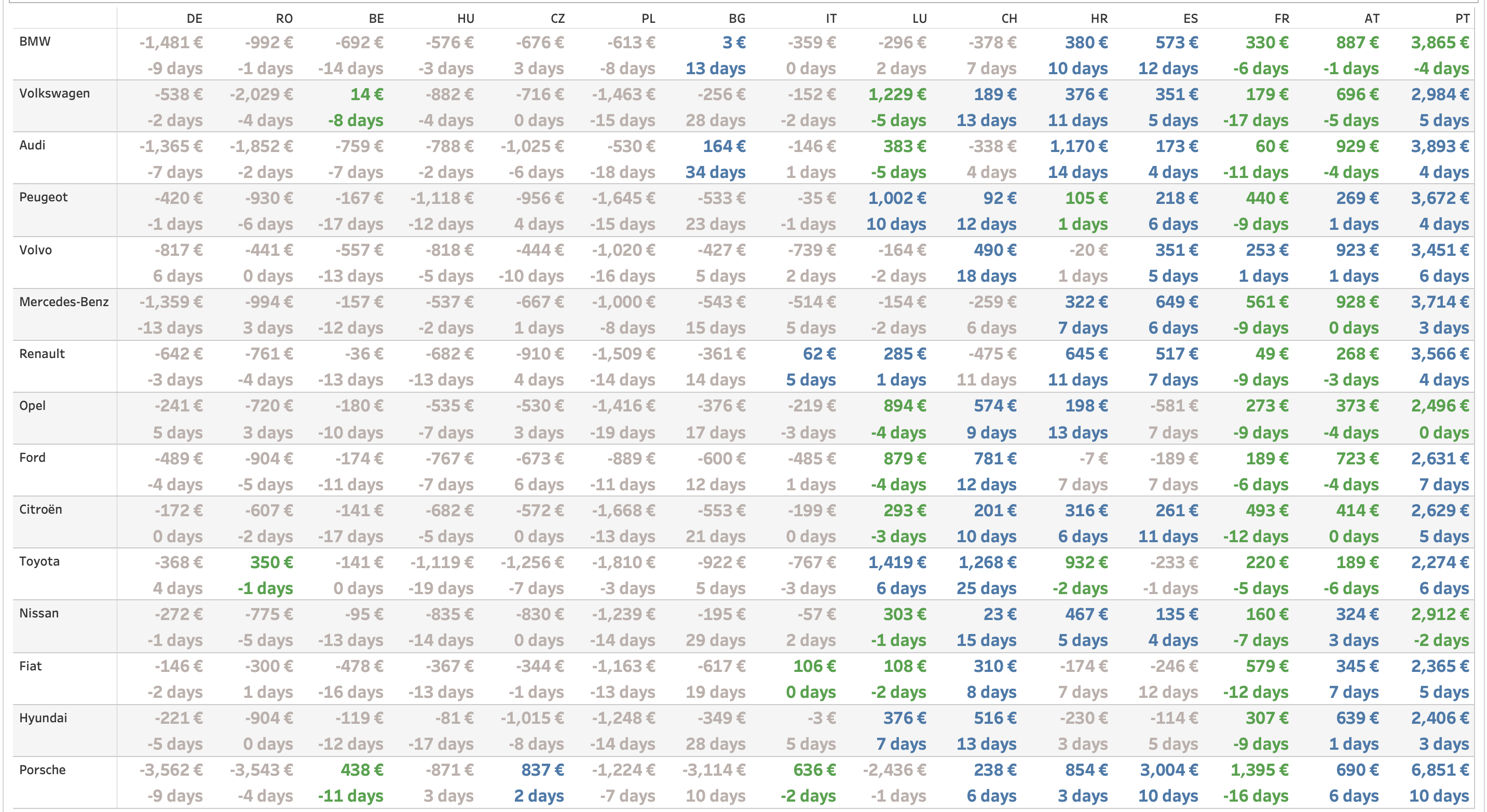

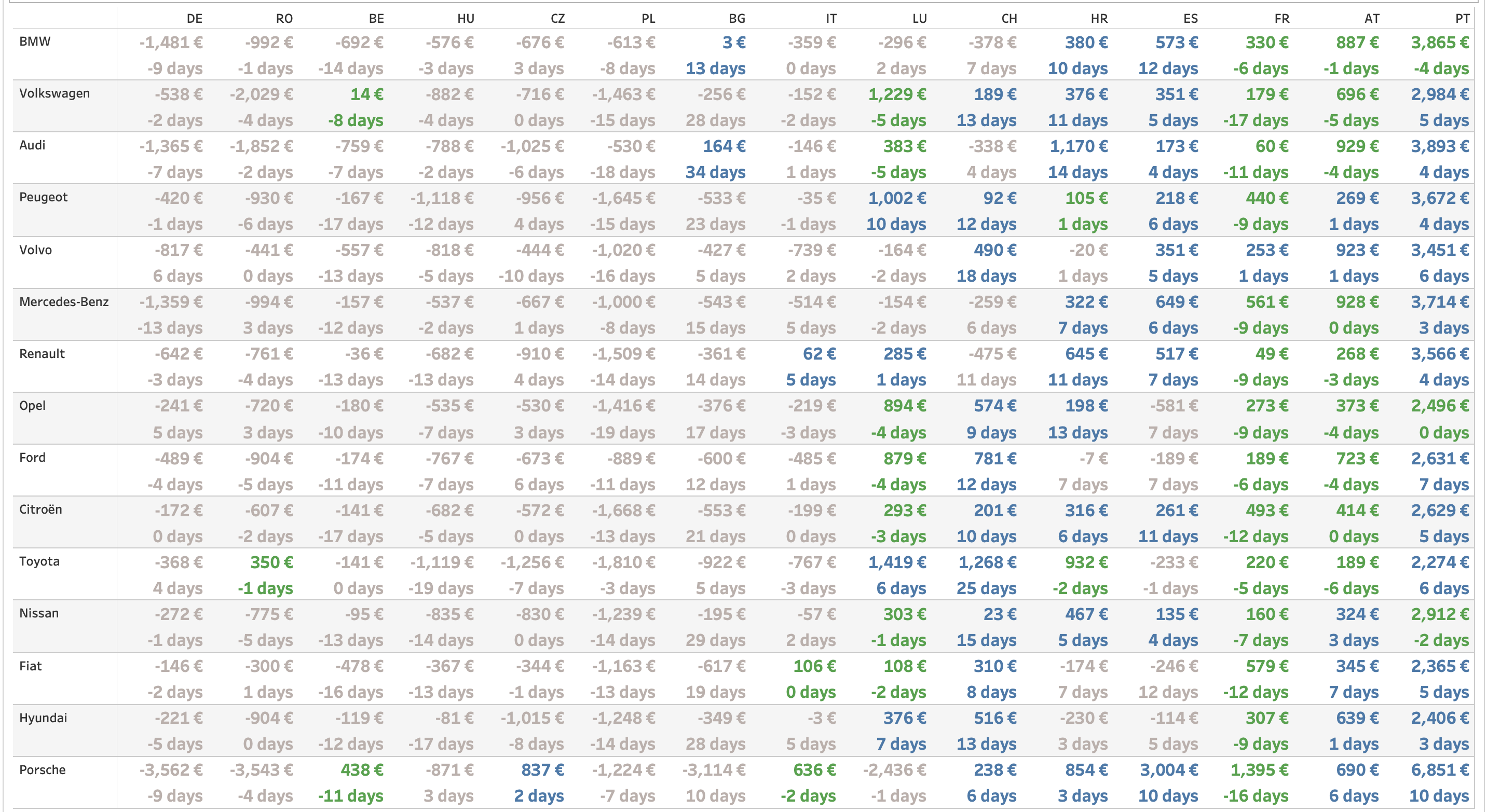

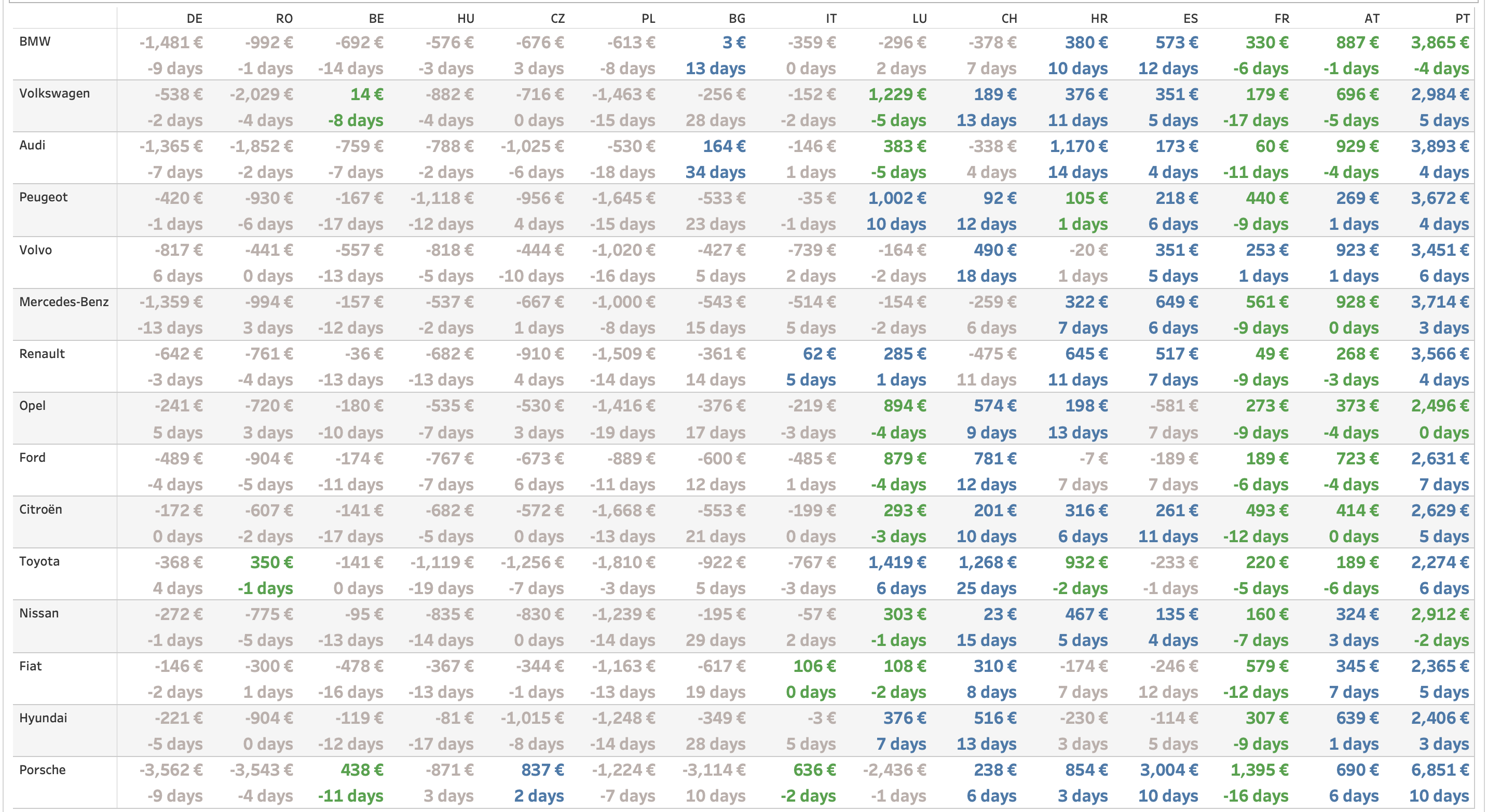

A panoramic vision of the European market

The following tables are showing the performance of each country versus the European average. We’ve highlighted in blue the countries for which the average market value is higher than the overall pricing. And in green, we’ve identified the makes where the value, but also the time to sell are performing better than the rest of the countries.

At first glance, we see that the 3 “hottest” countries are, for the last 3 months, France, Austria and Portugal. Those last two are, by far, performing better for our main makes. More precisely, Austria has a strong time to sell (less stock days), while Portugal outperforms Europe for the market value. However, this doesn’t mean that we should only focus on those 2 markets. As we’ll see further, the situation is more nuanced if we dig deeper in the analysis. Also, as those 2 countries have a rather limited local market due to the size of the countries, they won’t be able to absorb all the volume coming from all over Europe.

One of the key learnings from these monthly table is the volatility. Just for one example, Belgium was overperforming Europe for Toyota in November, but not in the following 2 months. On the other hand, the same market was above for Volkswagen in December and January. More than ever, today’s truth is not always tomorrow’s! Only a close follow up allows the players in the market to take, at all time, the right decisions.

Same brand, different behaviours

If we dive a little deeper in the analysis, we see that the situation is, as we said before, more nuanced.

For example, when we focus on the different models within a make, we see clear differences in the ranking of countries for the highest market value.

BMW shows an interesting profile for this analysis. The ranking of Portugal as highest country remains correct, but we see that for the X series (X1 & X3 in this top 10), the Netherlands offer an even higher customer market value. Portugal is not even in the top 3 for the X3.

Still focusing on body types, we can clearly see that, in the last 3 months, Austria was offering the best pricing opportunities for LCV’s within the Volkswagen models (Transporter & Caddy).

Timing… is everything!

As we’ve already seen, the situation can vary country by country, model by model. But we also see a variation month after month.

By analysing the Mercedes model range, we can see changes. Just an example: for the Class E Break, Austria was leading the ranking for December and January, but was only in third position in November. The Netherlands were on the second rank in December for the CLA Shooting Brake, but left the top 3 the next month.

Shooting a moving target…

In conclusion, it’s essential for our market to understand the key challenges we’re facing. Selling the right car at the right moment for the right public is possible. For you as a seller it’s the best way to optimize the financial return.

At the same time, for buyers, understanding the right product for their local market is the best way to focus on the right vehicles and creating value.

The usage of comprehensive market data is also a great help to identify the best opportunities. In the complex economic situation we face today, intelligence is more than ever a critical asset. By linking a large vehicle offer to a wide range of buyers from several markets, OPENLANE enhances the chance to optimize the sales result.